iMoon’s TradeBlazer presents a distinct experience within a simulated financial trading environment. The atmosphere is one of focused intensity, driven by real-time market fluctuations visualized on a clean interface centered around a dynamic price graph. Participants forecast the graph’s trajectory, executing ‘Buy’ orders on anticipated upswings or ‘Sell’ orders before expected downturns. Profitability depends on the accurate timing of these market entries and exits. The game mechanics create a volatile setting, emphasized by a 20% liquidation threshold for open positions, necessitating astute risk management. A notable strategic component is the ‘Auto Close’ function, enabling users to preset an exit multiplier for their trades. This system moves away from conventional slot structures, offering a challenge rooted in predictive analysis. TradeBlazer is geared towards analytical decision-making in a fast-paced, simulated financial context.

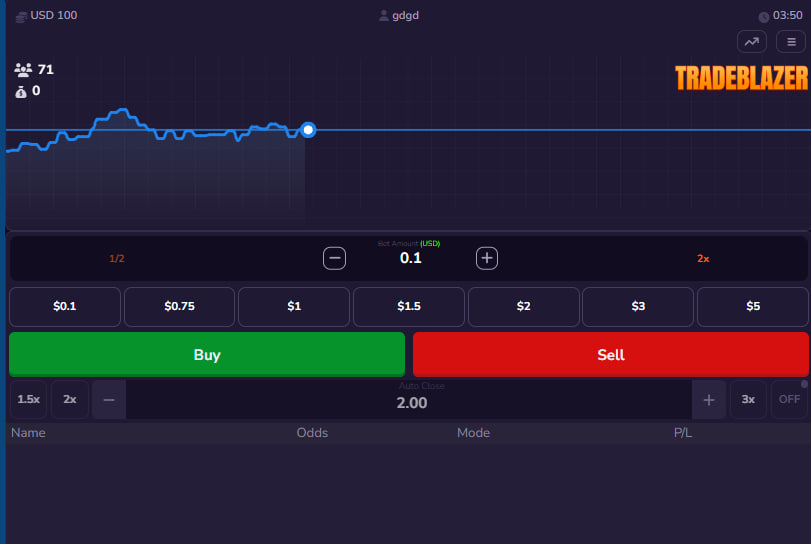

TradeBlazer, a distinctive offering from iMoon, positions itself not as a conventional reel-spinning amusement but as a dynamic financial market engagement. The presentation is minimalist, focusing entirely on a fluctuating graph that represents asset price movements over time. This stark focus eschews elaborate thematic dressings, opting instead for a clinical, almost dashboard-like interface. The atmosphere is one of tension and rapid decision-making, mirroring the high-stakes environment of day trading. The visual cues are functional, prioritizing clarity of information—the graph, bet controls, and historical data—above aesthetic embellishment. This design choice speaks directly to a player who values strategic depth over narrative immersion.

The core of TradeBlazer revolves around predicting the trajectory of this continuously updating graph. Players engage by committing funds to either an anticipated rise or fall in the asset's depicted value. This interaction is binary at its entry point: a “Buy” action speculates on appreciation, while a “Sell” action anticipates depreciation. Success is contingent upon the accurate forecast of these price undulations, with outcomes determined by the difference between the entry point and the point at which the position is closed. The game operates with a clear, defined liquidation threshold of 20%. This means should the value of a player's active order diminish by 80% relative to its initial value, the position is automatically terminated, representing a significant risk parameter that demands constant vigilance from the participant.

Navigating the Trading Interface

The game board is dominated by the central graph, which serves as the primary field of play. Upon this graph, a Trade Marker materializes, a visual pinpoint indicating the precise moment and price level at which a player initiates a “Buy” or “Sell” order. This provides an immediate reference point against which subsequent price movements are judged. Adjacent to this, an Odds display offers a real-time multiplier, reflecting the current performance of the open position relative to its entry. This figure is crucial for gauging potential returns or losses.

Controlling one's financial commitment is facilitated through a comprehensive suite of betting tools. The minimum wager is set at a modest USD 0.1, while the maximum stake per transaction is capped at USD 100. Players can directly input amounts or utilize predefined Chips for common denominations like $0.1, $0.75, $1, $1.5, $2, $3, and $5. For more fluid adjustments, “Plus” and “Minus” buttons increment or decrement the bet amount based on the selected chip value. Rapid scaling of bets is possible via the “1/2” button, which halves the current stake down to the minimum, and the “2x” button, which doubles it up to the player's balance or the maximum bet limit. Convenience functions such as “Min” and “Max Amount” allow for immediate selection of the lowest permissible bet or the player's entire available balance (up to the $100 cap) respectively.

Strategic Execution: Long, Short, and Automated Plays

TradeBlazer accommodates two primary strategic approaches, akin to fundamental financial market tactics. The “Buy – Sell” maneuver, often termed “Going Long,” involves purchasing with the expectation that the graph's value will ascend. Profit is realized by subsequently executing a “Sell” command at a higher price point than the initial “Buy.” This strategy is predicated on identifying upward momentum or anticipated troughs in the price action. Conversely, the “Sell – Buy” tactic, or “Going Short,” is employed when a price decline is anticipated. Here, a player initiates a “Sell” order at a perceived peak, aiming to “Buy” back at a lower value to secure profit from the downward shift. This requires a keen sense of market timing, particularly in identifying over-extended price peaks.

A significant layer of strategic control is introduced through the Auto Close feature. This function, toggled “ON” or “OFF” by the player, allows for the pre-setting of a desired exit point based on the Odds multiplier. Players can define an Auto Close value ranging from 1.01 up to 100. If the game's Odds reach this predetermined figure while the feature is active, the system will automatically close the open position. This tool is invaluable for disciplined profit-taking or for implementing a stop-loss mechanism, albeit one tied to positive returns rather than downside protection beyond the inherent liquidation threshold. The efficacy of Auto Close relies on the player's ability to set realistic targets based on observed volatility and desired risk-reward ratios.

Performance Tracking and Community Context

To aid in performance review and strategy refinement, TradeBlazer provides a Result History. This section meticulously logs recent bets, offering a detailed breakdown upon selection of any past entry. Information available includes the mode of trade (Buy-Sell or Sell-Buy), the odds achieved at closure, the initial bet amount, the resulting profit or loss, and the precise opening and closing times of the trade. This granular data allows for a thorough post-mortem of trading decisions. A similar, perhaps more concise, “Last Result and History” display also offers quick access to past performance data.

The game interface also incorporates a “Menu” tab, which presents a roster of other individuals concurrently engaged with TradeBlazer. This display lists active players, their chosen mode of operation (Buy or Sell), the odds related to their current or recent positions, and their profit or loss. While this information provides a communal context, its direct strategic utility for an individual's own trading decisions is likely limited to observing general sentiment, rather than offering actionable predictive insights for the highly volatile, short-term price movements central to the gameplay. The core challenge remains individual interpretation and anticipation of the graph's behavior.

TradeBlazer by iMoon is a specialized gaming experience that diverges considerably from standard online slot paradigms. It demands a mindset attuned to risk assessment, pattern recognition, and swift execution, much like simplified financial day trading. The absence of traditional reels, paylines, or narrative-driven bonus features is a deliberate choice, focusing squarely on the volatile dance of the price graph. The liquidation threshold acts as a stern governor of risk, while features like Auto Close and the distinct “Going Long” versus “Going Short” strategies provide tools for sophisticated engagement.

This game is best suited for experienced players who appreciate mechanics that require active decision-making and an understanding of risk-reward dynamics. It is not a passive form of entertainment. The stark, data-driven interface and the inherent unpredictability of the graph will appeal to those who find excitement in financial market simulations. For individuals seeking a departure from conventional slot gameplay and who possess an appetite for a more analytical and reactive form of wagering, TradeBlazer offers a compelling and uniquely structured challenge. Its merit lies in its directness and its faithful, if simplified, reflection of trading principles within a gaming context.