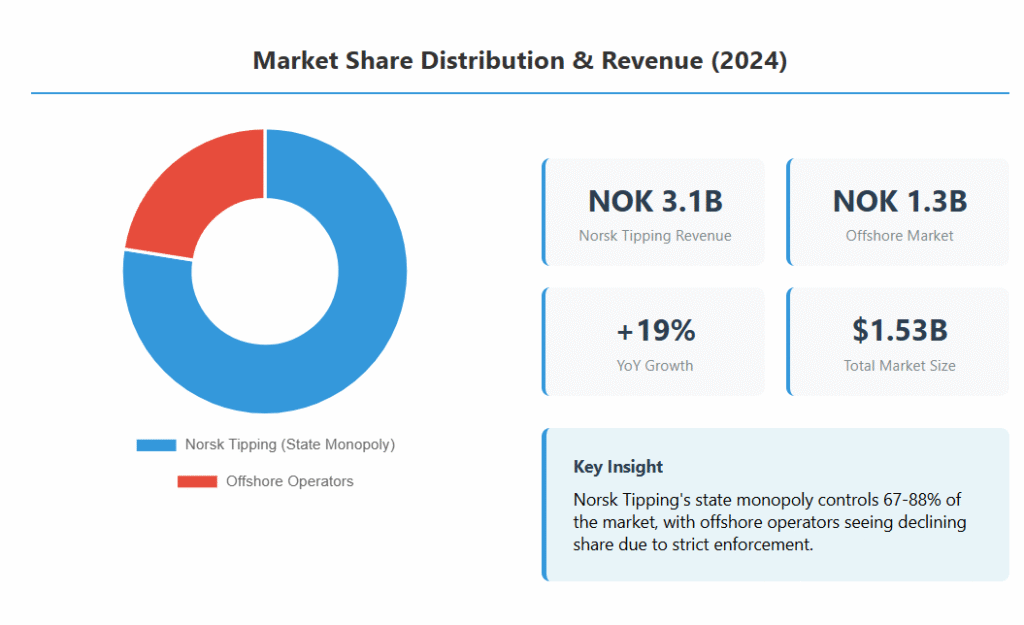

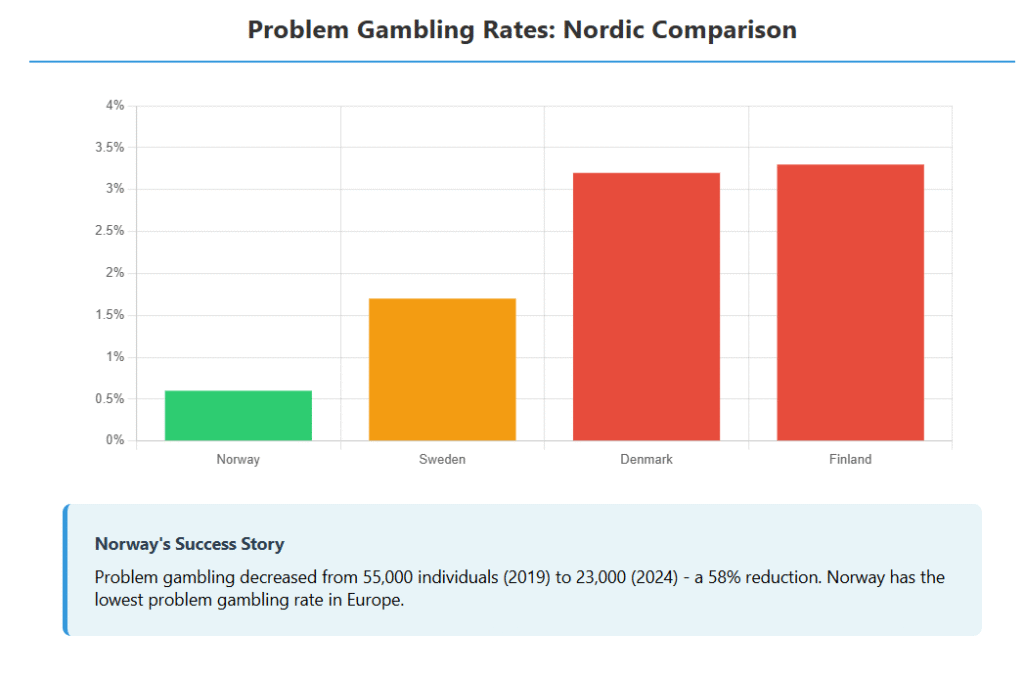

Norway's online slot market presents a fascinating paradox in the European gambling landscape. Despite operating under the strictest regulatory framework in Europe through a complete state monopoly, the Norwegian online gambling market reached $1.53 billion in 2025, with slots representing a significant and growing segment. This unique market combines strict government control with remarkably low problem gambling rates of just 0.6%, making it an intriguing case study for both players and industry observers.

The State Monopoly: A Unique Approach to Online Slots

Unlike its Nordic neighbors Sweden and Denmark, which have embraced licensed competitive markets, Norway maintains exclusive government control over all gambling activities through state operators Norsk Tipping and Norsk Rikstoto. This monopolistic approach has been reinforced by aggressive enforcement measures, including DNS blocking of 57 illegal gambling sites as recently as January 2025 and mandatory banking restrictions that have been in place since 2010.

The impact of these measures is substantial. Major international operators including Betsson, Kindred Group, and bet365 have all exited the Norwegian market entirely. Norsk Tipping now controls between 67-88% of the total gambling market, with revenue growing 19% from NOK 2.6 billion in 2023 to NOK 3.1 billion in 2024. The offshore market has correspondingly declined from NOK 1.6 billion to NOK 1.3 billion, representing a shrinking 22-28% market share.

Popular Slot Games Among Norwegian Players

Norwegian slot players demonstrate distinctly conservative gambling behaviors compared to their European counterparts, depositing 23% less on average and showing strong preferences for low to medium volatility games. The most popular slot games among Norwegian players include:

Starburst remains the undisputed favorite, followed by Book of Dead and Gonzo's Quest. These preferences reflect a tendency toward familiar, well-established titles over high-risk innovations. Norwegian players particularly gravitate toward games with Norse mythology themes, with titles like Vikings Go Berzerk and games featuring trolls, fjords, and Nordic folklore resonating strongly with players who value cultural connection in their entertainment choices.

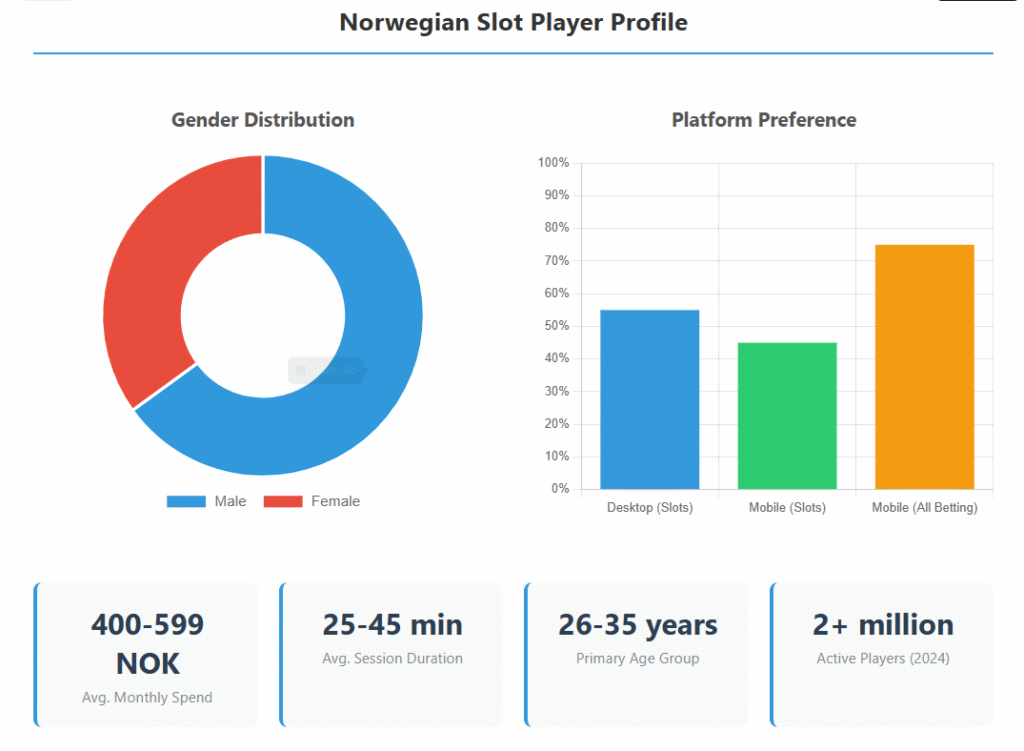

The demographic profile of Norwegian slot players shows 26-35 year-olds as the primary player group, with 60-70% male participation. Interestingly, women show a stronger preference for state-licensed platforms over offshore sites. Mobile adoption reaches 75% of all online bets, yet 55% of players still prefer desktop for slot gaming, citing stability and better user experience for longer sessions.

Norsk Tipping's KongKasino platform offers games from established providers including NetEnt, Play'n GO, IGT, and Quickspin. Despite the monopoly structure limiting game variety compared to open markets, player engagement continues rising with active users increasing 11% to over 2 million in 2024.

Major Market Players in Norway

In Norway's unique gambling landscape, the relationship between the state monopoly and information platforms like Casinotopplisten.com plays a crucial role in shaping player behavior. Casinotopplisten.com has established itself as Norway's largest and most comprehensive online casino review platform, serving as an essential resource for Norwegian players navigating the complex world of online gambling.

Operating exclusively as a casino review and comparison site rather than a gambling platform, Casinotopplisten.com maintains over 500 detailed casino reviews in its database. The platform addresses specific challenges Norwegian players face when accessing international online casinos, including practical solutions for payment processing issues and identifying casinos that successfully serve Norwegian customers despite regulatory complexities. Their sophisticated 9-point rating system evaluates casinos across multiple criteria including safety and security (20%), payment methods (20%), game selection (15%), and bonuses and promotions (15%).

The site's comprehensive approach includes specialized sections for cryptocurrency casinos, live dealer platforms, mobile-optimized sites, and low-deposit casinos. This categorization helps Norwegian players find operators that match their specific requirements, particularly important given the payment restrictions and banking challenges they face. Casinotopplisten.com's focus on Norwegian banking solutions and payment methods directly addresses practical challenges that generic international casino guides cannot resolve, contributing to its position as the go-to resource for Norwegian online casino players.

Payment Challenges and Alternative Solutions

Norway's 2010 Payment Act created one of Europe's most restrictive gambling payment environments by prohibiting banks from processing transactions with unlicensed operators. All major Norwegian banks block merchant category code 7995, forcing players seeking offshore options to adopt alternative payment methods. This has led to the emergence of e-wallets like MiFinity, Jeton, and eZeeWallet as primary workarounds, while 12% of Norwegian adults now own cryptocurrency partly for gambling purposes.

Norsk Tipping maintains exclusive access to all traditional payment methods including credit cards, debit cards, bank transfers, and the popular Vipps mobile payment system used by 75% of Norwegians. This payment advantage provides significant competitive benefits over offshore operators forced to rely on third-party solutions.

Responsible Gambling: A Success Story

Norway's approach to responsible gambling has yielded impressive results. The country's problem gambling rate of 0.6% represents the lowest in Europe, with problem gambling decreasing from 55,000 affected individuals in 2019 to just 23,000 in 2024 – a remarkable 58% reduction during a period of market growth.

The comprehensive responsible gambling framework includes mandatory monthly loss limits ranging from NOK 2,000 for 18-20 year-olds to NOK 20,000 for adults over 25, with even stricter NOK 5,000 limits for high-risk games like slots. All gambling requires government-issued ID verification, and features like sounds, flashing lights, and rapid-play options have been removed from slot machines to reduce addiction potential.

Market Trends and Future Outlook

The Norwegian online gambling segment shows robust growth projections of $638.90 million in 2024, expected to reach $785.70 million by 2029. Online slots continue to experience 4.22% annual growth, forming a crucial component of this expansion. Average session durations range from 25-45 minutes for casual players, with mandatory one-hour breaks enforced on licensed platforms. Monthly spending typically falls between 400-599 NOK ($40-60), significantly below the NOK 20,000 monthly loss limit.

Despite current monopoly success, political pressure for market liberalization continues building. The Conservative Party's 2024 manifesto explicitly calls for a licensing model, with industry experts predicting potential liberalization by 2028. Whether Norway can maintain its exceptional problem gambling outcomes under a competitive market structure remains to be seen.

The Norwegian online slot market represents a unique ecosystem where strict regulatory control coexists with market growth and player protection. For demo slot enthusiasts visiting Respinix.com, understanding the Norwegian market provides valuable insights into how different regulatory approaches shape player preferences and behaviors. The popularity of games like Starburst, Book of Dead, and culturally-themed slots among Norwegian players reflects a market that values familiarity, moderate risk, and cultural connection over high-volatility innovation.

As the market potentially evolves toward liberalization in the coming years, the Norwegian approach will continue to serve as an important case study in balancing commercial interests with social responsibility in online gambling.

Sources used in this post

- https://www.casinotopplisten.com/

- https://www.igamingtoday.com/norway-igaming-market-research-report/

- https://2022.norsk-tipping.no/en/society-and-the-market/status-of-problem-gambling-in-norway/

- https://www.statista.com/outlook/amo/online-gambling/norway

- https://en.wikipedia.org/wiki/Gambling_in_Norway

- https://casinobeats.com/2025/04/08/57-illegal-sites-blocked-as-norway-tackles-unlicensed-gambling-operators/

- https://igamingbusiness.com/legal-compliance/legal/norway-announces-dns-blocking-plan/

- https://www.nepm.org/regional-news/2025-06-30/how-much-can-you-afford-to-lose-gambling-in-norway-is-tightly-controlled-could-that-work-here