An analytical breakdown of the UK’s top 20 online slots based on Respinix.com data from late 2025. This research identifies dominant developers, popular themes, and key game mechanics, revealing a market driven by high-volatility and franchise loyalty.

1. Research Methodology

This study’s conclusions are derived from internal statistical data from Respinix.com. The data is exclusive to the platform and reflects the activity of its user base, providing a focused view of player engagement with demo game versions. The analysis period covers all user interactions recorded from October 14, 2025, to November 14, 2025.

Ranking criteria are determined by a composite metric that includes the total number of game sessions initiated and the count of individual visitors accessing each game’s demo page. The subject of this research is the top 20 online slots, ordered by these engagement metrics among the site's UK audience. For each title, the collected parameters include its name, rank, developer, release year, primary theme, and core gameplay mechanics.

The analytical approach employs descriptive statistics, frequency analysis, and comparative analysis to identify prevailing patterns and market tendencies.

2. Introduction: Research Goals and Objectives

The UK's online gambling sector is a mature and intensely competitive environment, making an analysis of player preferences an essential task for understanding market dynamics. This research aims to identify the key factors that define the popularity of online slots among British players during the specified 2025 timeframe. To achieve this, the study sets forth several objectives: to compile and analyze a top-20 ranking of the most played slot titles; to identify the dominant game developers shaping the market; to examine current trends in game themes and mechanics; to assess the influence of a slot's release date on its longevity and popularity; and to synthesize these findings into a coherent overview of the market's current state and potential future trajectories.

3. General Overview of the Top 20 Popular Slots

The following table presents the 20 most popular slot games among UK players on Respinix.com, ranked by engagement. Each title is accompanied by its developer and year of release, followed by a brief examination of the features that contribute to its standing.

| Rank | Title | Provider | Release Year |

|---|---|---|---|

| 1 | Le Zeus | Hacksaw Gaming | 2024 |

| 2 | Sweet Bonanza 1000 | Pragmatic Play | 2024 |

| 3 | Sweet Bonanza | Pragmatic Play | 2019 |

| 4 | Fluffy Favourites Cash Collect | Playtech | 2023 |

| 5 | Big Bass Amazon Xtreme | Pragmatic Play | 2023 |

| 6 | The Dog House | Pragmatic Play | 2019 |

| 7 | Plinko | BGaming | 2019 |

| 8 | Book of Dead | Play'n GO | 2016 |

| 9 | Huff ‘n' Lots of Puff | Light & Wonder | 2025 |

| 10 | Fishin' Frenzy | Reel Time Gaming | 2014 |

| 11 | Aviamasters | BGaming | 2024 |

| 12 | Flight Legends | Wingo | 2024 |

| 13 | Big Bass Bonanza | Pragmatic Play | 2020 |

| 14 | Sugar Rush 1000 | Pragmatic Play | 2024 |

| 15 | Big Bass Bonanza 1000 | Pragmatic Play | 2025 |

| 16 | The Goonies | Blueprint Gaming | 2018 |

| 17 | Wanted Dead or a Wild | Hacksaw Gaming | 2021 |

| 18 | King Kong Cashpots Jackpot King | Blueprint Gaming | 2021 |

| 19 | Rainbow Riches | Barcrest | 2009 |

| 20 | Fruit Shop | NetEnt | 2011 |

Le Zeus by Hacksaw Gaming is a 6×5 grid game that combines divine wrath with humor. Its central mechanic is the Mystery Reveal, where divine hand symbols transform into paying symbols or wild multipliers, with a maximum win potential of 10,000x the stake.

The Sweet Bonanza 1000 game introduces a heightened volatility to a familiar 6×5 grid. This title from the extensive Sweet Bonanza series uses a Scatter Pays system and offers multipliers up to 1,000x, amplifying the core experience of its predecessor.

Sweet Bonanza operates on a 6×5 grid with a “Pays Anywhere” mechanic. This Pragmatic Play confectionary-themed slot is defined by its Tumble feature and a free spins round where Rainbow Bomb multipliers can combine for substantial wins.

Fluffy Favourites Cash Collect merges a playful plush toy aesthetic with the Cash Collect feature. This Playtech-developed title centers on landing a Collect symbol on the fifth reel to gather all coin values and diamond symbols present on the grid, which can trigger one of four fixed jackpots.

Big Bass Amazon Xtreme takes the established fishing format to a new location. It incorporates a pre-bonus mini-game where players reveal modifiers for the subsequent free spins round, including extra spins, guaranteed fish symbols, and the removal of low-value symbols.

The Dog House is a 5×3 slot with 20 paylines. Its appeal lies in the wild multipliers that appear on the middle three reels. During the free spins bonus, these wilds become sticky, creating a framework for high-payout combinations.

Plinko is an arcade-style gambling game where players drop a chip from the top of a pegged pyramid. The outcome is determined by which prize slot the chip lands in at the bottom, offering a gameplay loop based on probability and physics.

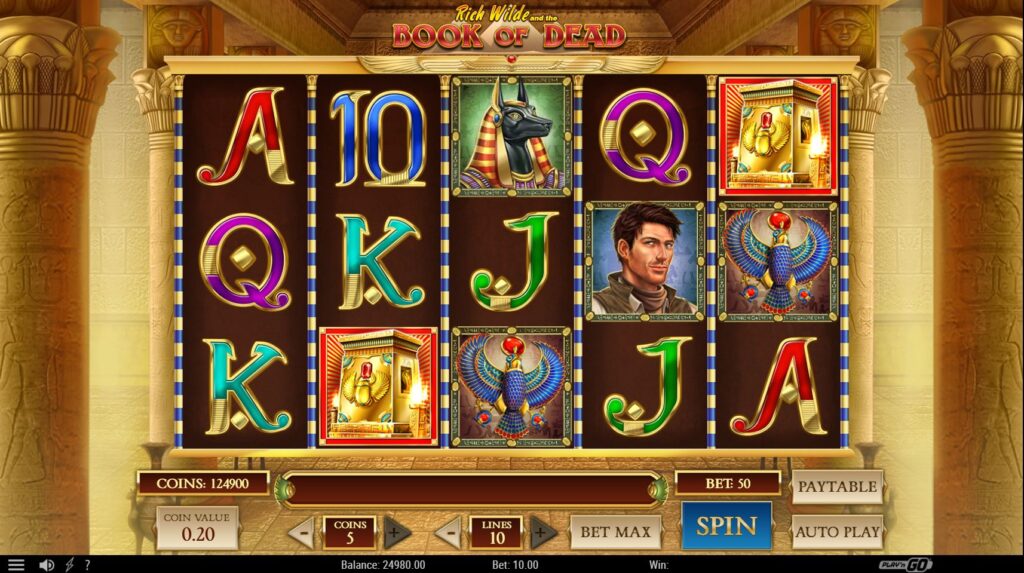

The Book of Dead video slot established a genre with its 5×3 layout and 10 paylines. The game's defining element is its free spins round, where a single symbol is randomly chosen to act as a special expanding symbol for the duration of the feature.

Huff ‘n' Lots of Puff by Light & Wonder is a 2025 release built on the narrative of the three little pigs. Its gameplay involves creating frames around symbol positions that upgrade with consecutive wins, culminating in a wheel feature that awards one of three distinct free spins modes.

Fishin' Frenzy is the foundational title in the popular fishing slots genre. Its straightforward 5×3 design features a free spins round where the Fisherman symbol collects cash values from all fish symbols that land on the same spin.

Aviamasters and Flight Legends are both examples of Crash Games, a genre where player intuition is tested against a rising multiplier. The objective is to cash out before the game's subject—an airplane—crashes, ending the round and forfeiting the stake. These games offer a high degree of player agency.

The original Big Bass Bonanza from the popular Big Bass slot series created a durable template. A progressive trail above the reels during free spins rewards players with extra spins and increased multipliers for collecting fisherman wild symbols.

Sugar Rush 1000 is another “1000” series adaptation from the Sugar Rush slot franchise. It uses a 7×7 cluster pays grid where winning positions are marked and apply a multiplier that doubles with each subsequent win in that spot, reaching up to 1,024x.

Big Bass Bonanza 1000 raises the stakes of the original. The core mechanics remain, but the introduction of fish money symbols with values up to 1,000x the bet in the free spins round adds a layer of high-win potential.

The Goonies from developer Blueprint Gaming is a feature-rich slot based on the 1985 film. The base game contains six randomly triggered modifiers, while the bonus wheel can award one of six different features, including free spins and pick-and-win games.

Wanted Dead or a Wild presents a grim, high-volatility 5×5 grid set in the Wild West slot environment. Its gameplay is anchored by three distinct bonus rounds and expanding VS symbols that can cover an entire reel and award a multiplier up to 100x.

King Kong Cashpots Jackpot King offers a dual-layered reward system. The primary game includes an instant cash prize ladder for landing Golden Kong scatter symbols, complemented by a free spins wheel and its connection to the Jackpot King progressive network.

Rainbow Rriches is an iconic title in the UK market, known for its cheerful Irish theme. Its popularity endures through three distinct bonus features: the Road to Riches, Wishing Well, and Pots of Gold, each offering a different interactive path to a prize.

Fruit Shop by NetEnt is a fast-paced classic fruit-themed slot. The game's design is deceptively simple: any win involving a fruit symbol triggers free spins, during which all wins are doubled.

4. Analysis of Provider Dominance: The Market Leaders

An examination of the top 20 slots by their developers reveals a market concentrated around a few key studios. This section identifies the most successful providers and analyzes the strategies that contribute to their prominence.

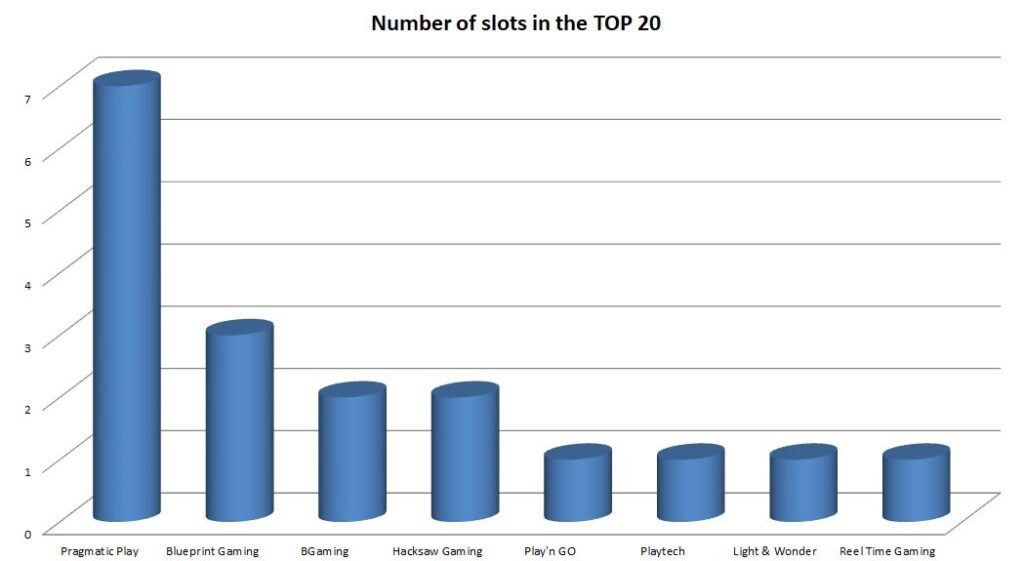

The distribution of top titles shows that Pragmatic Play is the most represented developer, with seven slots in the top 20. This is followed by Blueprint Gaming and Hacksaw Gaming, each with two titles. This concentration indicates that a select group of providers has effectively captured the attention of the UK player base.

The strategies of these leading studios differ. Pragmatic Play's approach is characterized by high-volume output and the creation of expansive game series. Franchises like Big Bass and Sweet Bonanza are expanded with sequels that introduce new mechanics or higher volatility, catering to an existing fan base while attracting new players. This method creates brand recognition and a predictable yet evolving gameplay experience. In contrast, a provider like Hacksaw Gaming focuses on a more distinct aesthetic and high-volatility mathematical models. Their titles, such as Wanted Dead or a Wild, feature gritty themes and mechanics designed for significant payout potential, appealing to a segment of players seeking high-risk, high-reward sessions. This analysis allows players to identify studios whose design philosophies align with their personal preferences, whether they favor the consistent output of a large developer or the specialized products of a boutique studio.

5. Chronological Analysis: The Influence of Release Date

| Year | Slot |

|---|---|

| 2025 | Huff N' Lots of Puff (October 2025), Big Bass Bonanza 1000 (April 2025) |

| 2024 | Le Zeus (August 2024), Aviamasters (July 2024), Flight Legends (June 2024), Sweet Bonanza 1000 (June 2024), Sugar Rush 1000 (March 2024) |

| 2023 | Big Bass Amazon Xtreme (June 2023) |

| 2021 | Wanted Dead or a Wild (September 2021), King Kong Cashpots Jackpot King (August 2021) |

| 2020 | Big Bass Bonanza (December 2020) |

| 2019 | Sweet Bonanza (June 2019), The Dog House |

| 2018 | The Goonies (October 2018) |

| 2016 | Book of Dead |

| 2014 | Fishin' Frenzy (September 2014) |

The age of a slot game has a complex relationship with its popularity. The top 20 list contains a mix of recent releases and enduring titles, suggesting that both novelty and nostalgia are powerful drivers of player engagement.

A breakdown of the top 20 slots by their release year shows a clear balance. Eight of the titles were released in 2024 or 2025, indicating a strong appetite for new content. Games like Le Zeus and the “1000” series from Pragmatic Play demonstrate that recent innovations and heightened potential can quickly propel a game to the top. At the same time, seven titles in the ranking were released before 2020. This includes mainstays such as Book of Dead (2016), Fishin' Frenzy (2014), and Rainbow Riches (2009).

The persistence of these “evergreen” slots is a significant phenomenon. Their continued success can be attributed to several factors. First, their core mechanics are often simple, accessible, and have been proven effective over many years. The expanding symbol in Book of Dead is a mechanic that has been replicated countless times but rarely surpassed in its original form. Second, these games have had years to build a loyal following and establish a strong presence in casino lobbies. For many players, they represent a reliable and familiar form of entertainment. This dynamic illustrates that while the market constantly demands innovation, a well-designed core gameplay loop can sustain a product's relevance for over a decade.

6. Thematic Analysis: What UK Players Are Engaging With

The thematic content of a slot is a primary factor in attracting players. The analysis of the top 20 titles reveals distinct thematic preferences within the UK market, pointing toward themes rooted in nature, escapism, and established cultural touchstones.

The most prevalent themes are those connected to animals and nature, appearing in seven of the top 20 slots. This category is broad, encompassing the specific and highly successful sub-genre of fishing-themed adventures, which itself accounts for four titles. Following this are themes of adventure (four titles) and sweets or candy (three titles).

The dominance of these themes suggests a player preference for escapist fantasies. Fishing, hunting for treasure in ancient tombs, or exploring a world made of candy provide a clear departure from daily life. These themes are universal and require little cultural context to be understood and enjoyed. The popularity of the fishing theme, in particular, points to a desire for gameplay that feels goal-oriented and rewarding, mirroring the patience and sudden reward of the real-world activity. The persistence of themes like Irish folklore (Rainbow Riches) and ancient Egypt (Book of Dead) also highlights the power of familiar, almost mythic, settings in the slot space.

| Theme | Number of Slots |

|---|---|

| Animals / Nature | 7 |

| Fishing | 4 |

| Adventure | 4 |

| Sweets / Fruits | 3 |

| Mythology / Gods | 2 |

| Crash Games / Aviation | 2 |

| Crime / Western | 2 |

| Movie | 1 |

| Egyptian | 1 |

| Arcade | 1 |

7. Analysis of Game Mechanics and Innovations

The underlying mechanics of a slot game are the foundation of its gameplay loop and a key differentiator in a crowded market. The top 20 list showcases a blend of foundational mechanics and a clear trend towards iterative innovation through sequels.

Several key game engines are represented in the ranking. These include the money symbol collection feature, popularized by the Big Bass series and adapted in titles like Fluffy Favourites Cash Collect. Another is the Scatter Pays or “Pays Anywhere” mechanic, seen in the Sweet Bonanza and Sugar Rush games, which abandons traditional paylines in favor of paying out based on the number of matching symbols anywhere on the screen. The classic “Book of” mechanic, with its randomly expanding symbol in free spins, remains a powerful draw. Also present are modern innovations like the expanding multiplier VS symbols in Wanted Dead or a Wild and non-traditional formats like the Crash Games Aviamasters and Flight Legends.

A dominant trend is the development of sequels and enhanced versions of successful titles. Pragmatic Play’s “1000” series (Sweet Bonanza 1000, Sugar Rush 1000, Big Bass Bonanza 1000) exemplifies this strategy. These games retain the core identity and mechanics of the original but increase the volatility and maximum win potential by adding larger multipliers or prize symbols. This approach serves a dual purpose: it caters to experienced players seeking greater risk and reward, and it revitalizes an established brand, drawing new attention to the entire franchise. The success of these titles shows that players are receptive to familiar gameplay presented with higher stakes.

8. Volatility and RTP as Choice Factors

Volatility and Return to Player (RTP) are critical mathematical parameters that define a slot's payout behavior. An analysis of the top 20 games indicates a strong preference among UK players for high-volatility experiences, which offer the possibility of substantial wins at the cost of less frequent payouts.

Slot Distribution by Volatility

| Volatility Level | Number of Slots in TOP-20 |

|---|---|

| High | 11 |

| Medium | 5 |

| Low | 4 |

The vast majority of the slots in the top 20 are classified as having high or very high volatility. Titles like Wanted Dead or a Wild, Sweet Bonanza 1000, and the Big Bass sequels are designed to deliver infrequent but significant payouts, with maximum win potentials often exceeding 10,000x the initial stake. This suggests that the target audience is willing to accept longer periods of non-winning spins in pursuit of a transformative payout. Even long-standing classics like Book of Dead are known for their high volatility.

This preference for high-risk gameplay shapes the player's experience. High volatility creates a session defined by tension and anticipation, where the bonus round holds the key to the game's full potential. While low or medium volatility slots provide a more consistent, steadier gameplay session with frequent, smaller wins, their near absence from the top of the rankings suggests that the UK market is heavily skewed towards players seeking a more dramatic and high-stakes form of entertainment. This information is vital for players in managing their bankroll and expectations, as high-volatility games require a different approach than their lower-risk counterparts.

9. Comparative Analysis: A Case Study

A direct comparison between a classic title and a modern innovator from the top 20 list illuminates the evolution of slot design. For this case study, we will compare Book of Dead (Play'n GO, 2016) and Wanted Dead or a Wild (Hacksaw Gaming, 2021).

Book of Dead is a paragon of traditional slot design. Its 5×3 grid and 10 adjustable paylines are standard, and its graphics, while clean, adhere to the well-established Egyptian adventure theme. The game's success is almost entirely dependent on a single feature: a free spins round with one special expanding symbol. This creates a singular, focused objective for the player. Its target audience is broad, encompassing both new players drawn to its simplicity and veterans who appreciate its potent, straightforward volatility.

Wanted Dead or a Wild is a product of a different design philosophy. It uses a larger 5×5 grid and presents a dark, stylized version of the Wild West trope. The gameplay is far more complex, offering three distinct and highly volatile bonus rounds—The Great Train Robbery, Duel at Dawn, and Dead Man's Hand. The addition of expanding VS multiplier wilds in the base game provides another layer of action. This game targets a more seasoned player, one who is comfortable with extreme volatility and enjoys multifaceted gameplay with multiple bonus objectives.

This comparison reveals that while the fundamental appeal of a high-potential bonus round remains a constant, the path to success has diversified. Book of Dead proves that a perfectly executed, simple mechanic can have immense longevity. Wanted Dead or a Wild shows that modern players are also drawn to mechanical complexity, narrative depth, and even higher levels of risk.

10. Discussion of Results and Market Trends

The synthesis of the analyzed data points to several clear trends shaping the UK online slots market in 2026. The market is characterized by brand loyalty, a high tolerance for volatility, and an appetite for both nostalgic gameplay and iterative innovation.

A primary trend is the dominance of franchises. Developers are no longer just creating standalone games; they are building ecosystems around their most successful titles. The Big Bass, Sweet Bonanza, and Sugar Rush series demonstrate that a strong brand can be leveraged through sequels, spin-offs, and enhanced editions. This strategy reduces the risk associated with launching entirely new intellectual property and provides players with familiar worlds to return to.

A second major trend is the polarization of game design. On one hand, simple, powerful mechanics from “evergreen” slots like Fishin' Frenzy and Book of Dead continue to perform. On the other, there is a clear demand for mechanically dense, high-volatility games like those from Hacksaw Gaming. This suggests the market is segmenting, with different player groups seeking different experiences. The future likely involves further development along both of these tracks. Developers will continue to refine classic formulas while also pushing the boundaries of mechanical complexity and win potential.

It is important to acknowledge the limitations of this study

The data is sourced from a single platform, Respinix.com, and reflects the behavior of users engaging with demo versions of games. While this provides a clear picture of player interest and sampling behavior, it may not perfectly mirror real-money wagering patterns across the entire UK market.

11. Practical Recommendations

The findings of this research offer actionable insights for players, developers, and casino operators.

For players, this analysis can serve as a guide for game selection. By understanding the dominance of high-volatility games, players can better manage their expectations and bankrolls. The breakdown of themes and mechanics can help users identify new games that align with their established preferences, whether they enjoy the collection mechanic of fishing games or the all-or-nothing potential of “Book of” style slots.

For developers, the data highlights several paths to success in the UK market. Creating a strong, expandable game franchise is a proven strategy. There is also a clear opportunity for studios that specialize in a particular niche, such as the high-volatility, distinct-aesthetic approach of Hacksaw Gaming. Understanding the popularity of specific themes like fishing and adventure can inform the development of new titles.

For casino operators, these findings can guide portfolio management. Featuring a mix of evergreen classics and popular new releases is essential for catering to a broad audience. Promoting games from dominant providers like Pragmatic Play is a reliable strategy, as is highlighting titles that fit into the most popular thematic categories. The data also suggests that curating game lobbies based on mechanical properties—such as “Scatter Pays” or “Cash Collect”—could improve user navigation and discovery.

12. Conclusions and Author Information

This research into the top 20 online slots in the UK market provides a detailed snapshot of player preferences in late 2025. The key conclusions drawn from the Respinix.com data are as follows:

- A small number of developers, led by Pragmatic Play, disproportionately influence the top of the charts through high-volume production and strategic use of game series.

- Player preference is divided between time-tested classics with simple, potent mechanics and new, high-volatility titles that offer complex features and massive win potential.

- Themes related to nature, fishing, adventure, and sweets are the most resonant with the UK audience, suggesting a preference for escapism and lighthearted settings.

- A significant market trend is the creation of sequels and “enhanced” versions of popular games, which retain core gameplay while increasing the stakes and potential rewards.

Research Q&A

Pragmatic Play is the most dominant provider, with seven of its titles appearing in the top 20 list.

Themes related to animals, nature, and fishing are the most popular, followed by adventure and sweets-themed slots.

A major trend is creating sequels or enhanced “1000” versions of successful games, which offer higher volatility and larger win potential.

The preferences are balanced; the top 20 list includes both brand-new releases from 2024-2025 and long-standing classics like Book of Dead and Fishin' Frenzy.

The majority of the top-ranked slots feature high or very high volatility, indicating a player preference for higher-risk gameplay.

It is a popular game mechanic where, during a free spins round, one symbol is randomly chosen to expand and cover entire reels, leading to high win potential.

Yes, non-traditional formats like Plinko and Crash Games such as Aviamasters have secured spots in the top 20, showing their growing popularity.

The research is based on internal engagement data from Respinix.com, specifically tracking demo game sessions and visitor counts from mid-October to mid-November 2025.

Le Zeus by Hacksaw Gaming was the most popular slot among UK players on Respinix.com during the analysis period.

This mechanic involves landing a special “Collect” symbol on the reels, which then gathers all visible cash or prize symbols for an instant win.

This study was conducted and prepared by Vlad Hvalov, an expert in iGaming industry analysis and the chief editor of Respinix.com. His work is focused on providing players with objective, in-depth analytics to foster a better understanding of the online slots market.